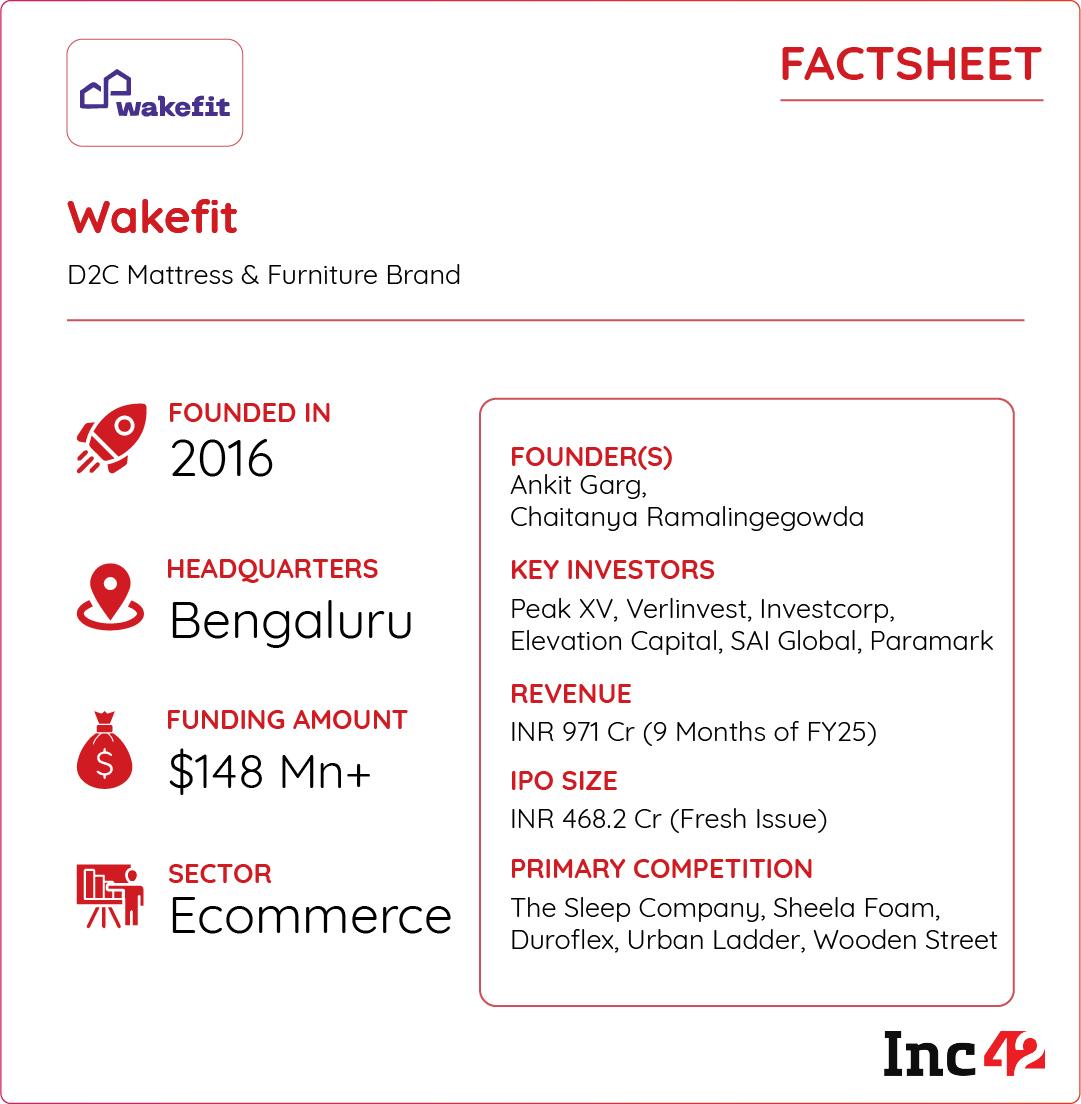

Peak XV-backed Wakefit has become the first new-age furniture and mattress brand to file for an initial public offering (IPO). While Sheela Foam, the 50-year-old category leader in the mattress segment, went public in 2020, Wakefit is on track to be the first new-age D2C furniture brand to make such a move in the space.

Following the footsteps of Mamaearth, Nykaa, and FirstCry, Wakefit is now set to carry forward the D2C IPO momentum. However, what’s worth noting is that Wakefit operates in what is considered a more tougher market compared to those peers.

In India’s 116 Bn+ ecommerce market, which has witnessed a D2C revolution in recent years, the growth of the furniture and home decor segment has remained largely muted. The segment has consistently fallen behind the fashion, beauty, and electronics goods markets.

In fact, as the Indian ecommerce sector grows to surpass $400 Bn in size by 2030, the furniture and home decor segment is expected to comprise only 6% of the total market share.

Not to mention, the online retail market for furniture presents challenges, including supply chain issues, price sensitivity, varied customer preferences based on culture and geography, and intense competition from unorganised players.

As a result, many companies have struggled to scale, and consolidation is quite a common spectacle in this space.

For context: Sheela Foam acquired Kurlon in 2023, HomeLane acquired Design Cafe last year, Reliance acquired Urban Ladder in 2020, and the list is far from over.

Against this backdrop, Wakefit’s growth over the years deserves some attention, especially when it is mulling a public listing.

So, what has it done differently to sustain growth despite challenges? And, what does the industry think about its IPO plans?

Experts believe that Wakefit stands out on the back of its mattress business and not the wooden furniture business, which is prone to major headwinds. Besides, the company should also be recognised for investing in research and development (R&D).

Wakefit’s DRHP highlights a Redseer research touting Wakefit as the only player among its home and furnishings peers, including LifeStyle, Godrej, D’Decor, Sheela Foam, Duroflex, IKEA and Royaloak, to have complete control over the entire value chain from R&D to prototyping and manufacturing.

Besides, its yearly earnings reports suggest that the startup has remained mindful of its operational costs. Further, having an end-to-end supply chain control is expected to have helped the startup manufacture products at a competitive price while keeping its procurement costs low.

For now, to understand Wakefit’s next chapter, it’s important to look at what its IPO entails.

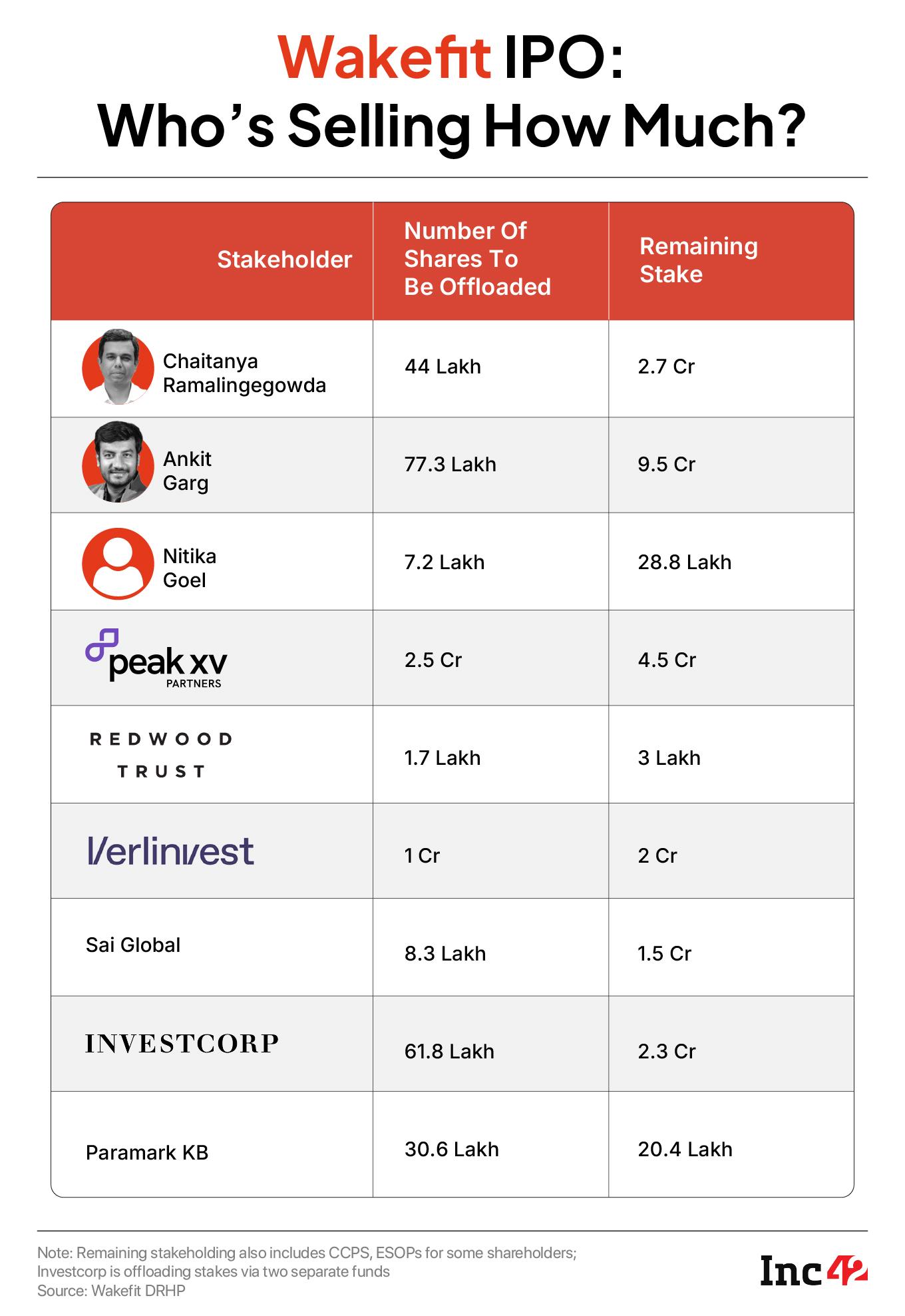

What’s In The Wakefit IPO Store?As per the company’s DRHP, it is looking to raise INR 468.2 Cr via fresh issue of shares. The IPO will comprise an offer for sale (OFS) component of up to 5.8 Cr equity shares.

Wakefit’s founders and promoters, Ankit Garg and Chaitanya Ramalingegowda, and some of its investors, including Peak XV Partners, Redwood Trust, Paramark, Investcorp and Verlinvest, will offload shares via OFS.

Among the investors, Peak XV is offloading the highest number of shares, up to 2.5 Cr. The VC fund invested $9 Mn (INR 65 Cr) in Wakefit’s first funding round in 2018. It held a 31.9% stake in the startup at the time.

Currently, Peak XV holds a 22.7% stake, or almost 7.1 Cr shares (including CCPS), which also makes the VC firm eligible to become a promoter. However, following the IPO, the VC major is expected to hold 4.5 Cr shares in Wakefit, bringing down its stakeholding significantly while giving it massive returns.

The next biggest shareholder in Wakefit is Verlinvest. It had invested $26 Mn in the online mattress brand in 2020. It holds 3 Cr shares, or a 9.89% stake, in the company. The Belgium-based VC firm is looking to sell 1 Cr shares.

Garg and Ramalingegowda will dilute up to 77.3 Lakh and 44.5 Lakh equity shares, respectively, during the IPO, as per the company DRHP.

The startup plans to use INR 82.1 Cr from the fresh proceeds to set up 117 new company-owned, company-operated regular stores and one jumbo store.

It is also planning to purchase new equipment and machinery worth INR 15.4 Cr for its manufacturing unit in Tamil Nadu.

A majority of its net proceeds, INR 145.2 Cr, will be used towards expenses for lease, sub-lease rent, and store licence fees. The remaining INR 108.4 Cr will be used towards marketing and advertising.

Inside Wakefit’s Financial MatrixWakefit’s growth has been steady in the last few years. Its operating revenue increased from INR 632.6 Cr in FY22 to INR 812.6 Cr in FY23 and INR 986.3 Cr in FY24. Similarly, its net profit margin improved, and Wakefit turned profitable at an EBITDA level in FY24.

In FY22, the startup posted an EBITDA loss of INR 74.9 Cr, which stood at INR 65.8 Cr in profit in FY24.

However, the company has yet to turn net profitable. In the first three quarters of FY25, Wakefit posted a loss of INR 8.8 Cr, which narrowed 41% year-on-year (YoY), while its operating revenue for this period stood at INR 971 Cr.

Since profitability is key to a strong stock market debut, Wakefit’s profitability status may tick off investors. However, the Wakefit IPO gives a huge scope to investors who want to diversify their investments.

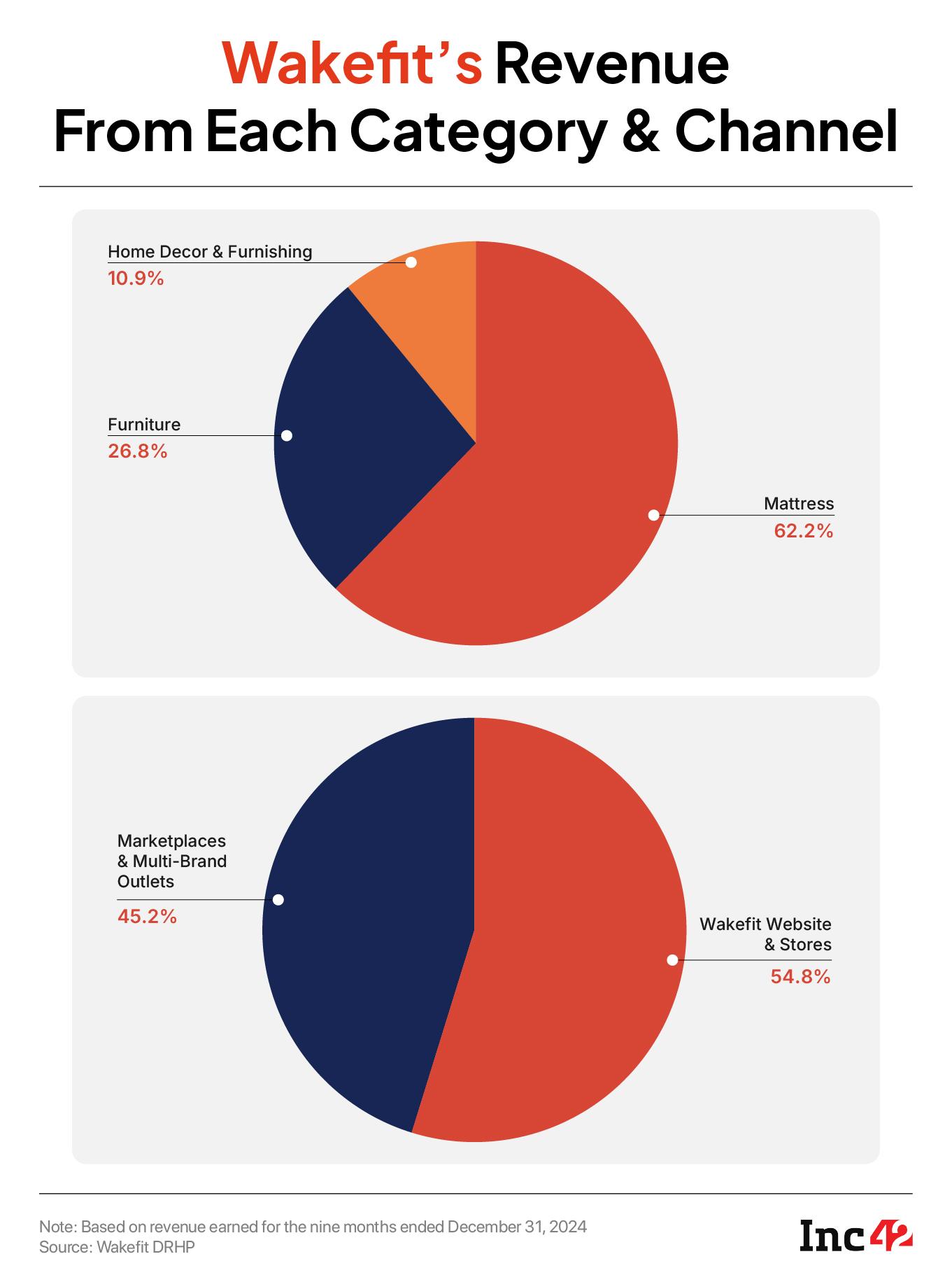

Wakefit’s Uphill BattlesWakefit has three main revenue streams — mattresses, furniture and home furnishings. Among these, mattresses remain its strongest pillar. The startup has built its brand name and loyalty in the mattresses segment, which brings 60% of the total revenue

However, there is a glaring concern. If one were to look at the pattern in this line of business, most players have struggled to scale after a point.

Pepperfry saw a decline in its revenue in FY24. The 2012-founded D2C furniture startup converted into a public entity in 2022 for a public market listing.

The IPO plan is still on hold. The company, rather, raised another INR 43 Cr from existing investors earlier this year.

Similarly, the 2012-founded Urban Ladder faced difficulties in scaling the business and wasacquired by Reliance Retailin 2020 at a 75% markdown from its total investment.

According to Satish Meena, the founder of Datum Intelligence, online furniture companies have struggled because of high logistics costs, including the complexities and costs associated with product returns, which also compromises customer experience. As a result, these brands started opening offline experience centres, but scaling these businesses has been difficult even then.

“This is due to the dominance of unorganised local retailers and because people’s taste for furniture is specific to regions.”

As per Meena, while the good thing about Wakefit is that it has built its business around mattresses, where logistics isn’t much of an issue, scaling in the furniture category may pose great challenges.

However, the market analyst sees the online home decor and furnishing category bringing in more revenues for the company in the coming days.

“This category doesn’t pose challenges similar to the furniture segment and is seeing traction even from tier II and beyond cities.”

Currently, furnishings contribute around 10-11% to Wakefit’s total revenue and furniture revenue contribution ranges between 20-30%.

However, the home and furnishings industry has a few structural issues.

Besides the logistics issues, there is price-sensitivity among consumers and weak brand loyalty, material and resource constraints, lack of product and pricing standardisation, short product cycles, and demand volatility.

The China Problem: In its DRHP, Wakefit has mentioned that any restrictions imposed by the Indian government on the import of raw materials or any embargoes on the jurisdictions where its suppliers are located, or any increases in import duties on these raw materials, may adversely affect the business.

Rohan Agarwal, a partner at Redseer, told Inc42 that foam is the largest cost component in mattress production and relies on raw materials such as polyols, diisocyanate dimer (DDI), and methylene diphenyl diisocyanate (MDI), which are primarily sourced from markets like China.

Therefore, international procurements expose these brands to global price volatility and trade policy risks.

At the same time, price sensitivity remains a major hurdle, particularly in tier II markets and beyond. Agarwal believes that home and furnishing brands need to put a lot more effort into providing consumers with better and less expensive products.

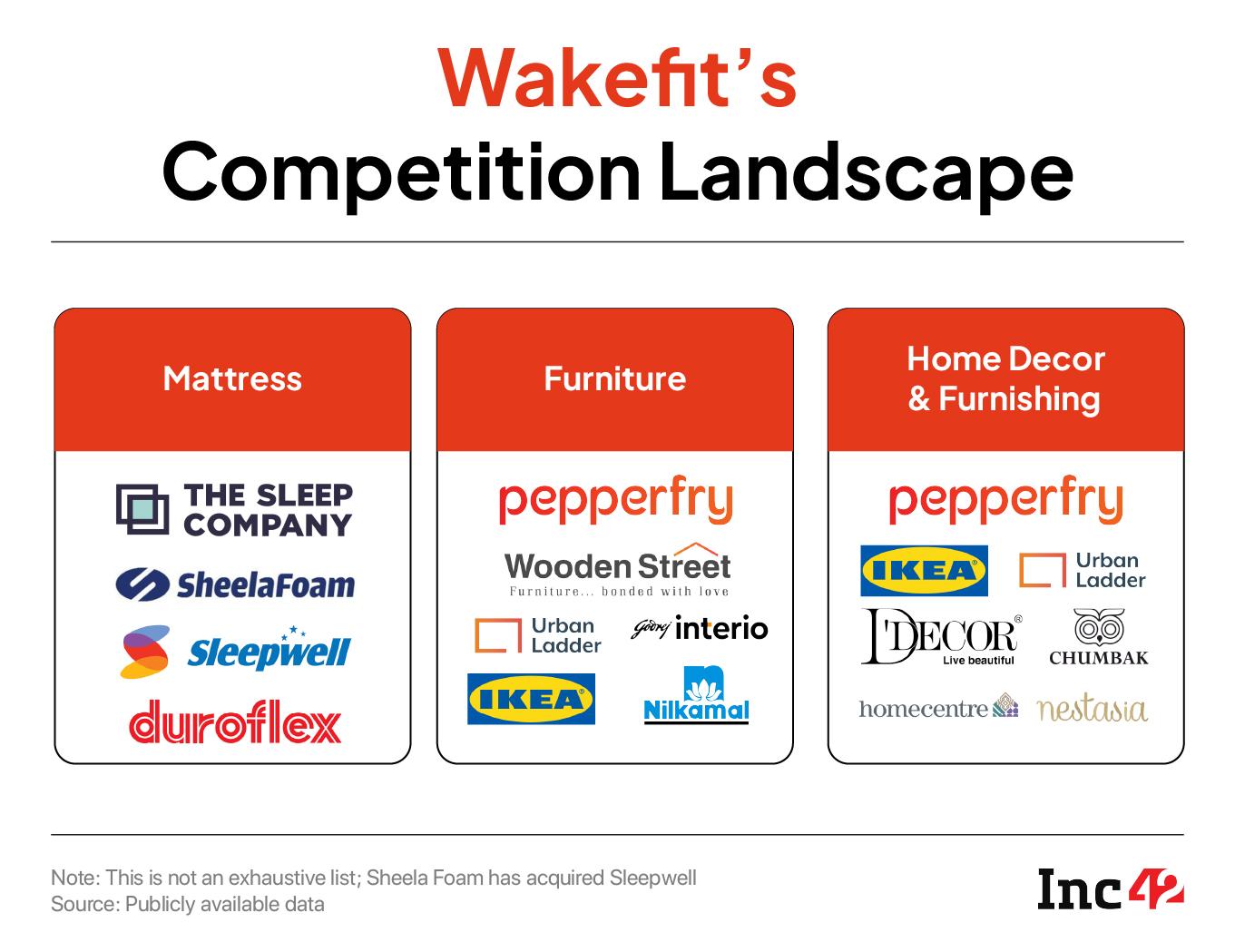

Competition Concerns: In the mattress business, Wakefit faces high competition from not only the legacy brands such as Sheela Foam and Duroflex, but also the likes of The Sleep Company and SleepyCat, among others. Hence, constant product quality innovation is key.

Founded in 2019, The Sleep Company crossed INR 300 Cr in revenue in FY24. Even though it doesn’t have plans to get listed anytime soon, it is expanding. The Sleep Company recently opened its 150th store, while Wakefit’s offline store count currently stands at 115.

In fact, Priyanka Salot, cofounder of The Sleep Company, told Inc42 that the company is now doubling down on penetrating deeper in tier II and tier III cities, while scaling profitably and product innovation. Despite challenges, it is betting heavily on strong tailwinds of rising consumer focus on health, better sleep, and premium home solutions.

Despite having a first-mover advantage, Wakefit’s IPO might be rocky. The startup is taking a major leap of faith by going public, but the long-term sustainability of its stock price will depend on multiple factors, as discussed above.

Referring to Mamaearth, which initially did well in the public markets but is now struggling due to its inability to scale, Datum Intelligence’s Meena said that investors are unforgiving in this category.

“I don’t think Wakefit will have much of a challenge pertaining to competition from other online players. But, unlike Mamaearth, Nykaa, and Firstcry, this mattress brand is not in a fast-growing category. Wakefit’s products are not high-frequency products, unlike beauty or fashion, and that’s where scaling could pose a challenge.”

However, consumer behaviour is shifting and household structures are changing, leading to an increasing demand in the home and furnishing category.

Redseer’s Agarwal noted that Indians have not been spending enough on their homes compared to Canada, the US, the UK, or China.

“While home has not really been at the forefront of consumer spending, a lot of signals are indicating a change, including the nuclearisation of families, the middle class having more disposable income, building up of aspirations due to exposure to a variety of trends and social media,” Agarwal added.

Experts say that for Wakefit to succeed in the long run, it has to crack the code of sustaining growth not just in mattresses but also in other segments. It will also need to sharpen its focus on tier II and beyond cities.

Meanwhile, Deroflex is also planning to launch its IPO by next year. While there is enough space in this segment for more players to go public, investors will reward only the best. This makes us ponder — Will Wakefit wake up to a blockbuster IPO?

[Edited by Shishir Parasher]

The post Will Wakefit Wake Up To A Blockbuster IPO? appeared first on Inc42 Media.

You may also like

Novak Djokovic fell to his knees after controversial Wimbledon moment vs Jannik Sinner

The once-thriving UK port town that's got a 'horrendous' new high street

One month after Ahmedabad plane crash: Silence and soot-covered buildings stand as grim reminders

Man Utd bank millions from sell-on fees including £7.2m for star who never played a game

Katie Taylor and Amanda Serrano must serve suspensions following third and final fight