For foodtech giants Swiggy and Zomato (now Eternal), the last few years have been about engaging in a battle for expansion, so much so that it has become difficult to tell them apart.

From quick commerce and cloud kitchens to intercity food delivery and even selling tickets for events and concerts, the two companies appear to be aping each other’s every move to be everything everywhere all at once.

However, what began as a bold bet to dominate every possible vertical falling under the ambit of food, lifestyle and entertainment is now undergoing a major course correction.

For starters, both are reconsidering their blitzkrieg, and while at it, they are gracefully stepping away from non-core bets, diluting underperforming or experimental units to focus on core operations to drive profitability.

For context: Zomato, which once saw the future of food logistics in ultra-fast deliveries, , Quick, four months after its launch in January. It has also pulled the plug on its home-made meal service, Zomato Everyday. Tailored for office-goers and budget-conscious consumers, the service was floated in January 2025.

Swiggy, too, has made similar retreats. It, its courier and pick-up-and-drop service that had gained popularity during the pandemic. The company also gave up on its private label food business by entering a strategic agreement with Kouzina, a chain of virtual restaurants, granting it exclusive rights to operate Swiggy’s digital-first food brands.

So, what has triggered this metaphorical fission in strategy?

One possible reason could be the growing realisation that profitability hinges on diversifying smartly rather than untamed expansion.

A market analyst, who did not wish to be named, pointed out that the duo’s attempt to rule their customers’ wallets for everything from food to groceries and entertainment to lifestyle has been quite ambitious. “The course correction was overdue,” the analyst said.

He believes that foodtechs are now forced to burn the visceral fat in the form of non-core businesses because those have been slowing them down, also eating into the revenues of core businesses and impacting operational efficiencies.

State Of Eternal Affairs: Zomato’s Diversification Saga“Moreover, the more the segments, the higher the chances of operational hiccups. Managing logistics, customer experience, and quality control across a wide array of verticals inevitably leads to fragmentation and strain on core operations,” he added.

Eternal’s push to transform Zomato into a broader lifestyle platform in 2024 was not only about ambition but also a strategic response to a slowing core business — food delivery, according to industry observers.

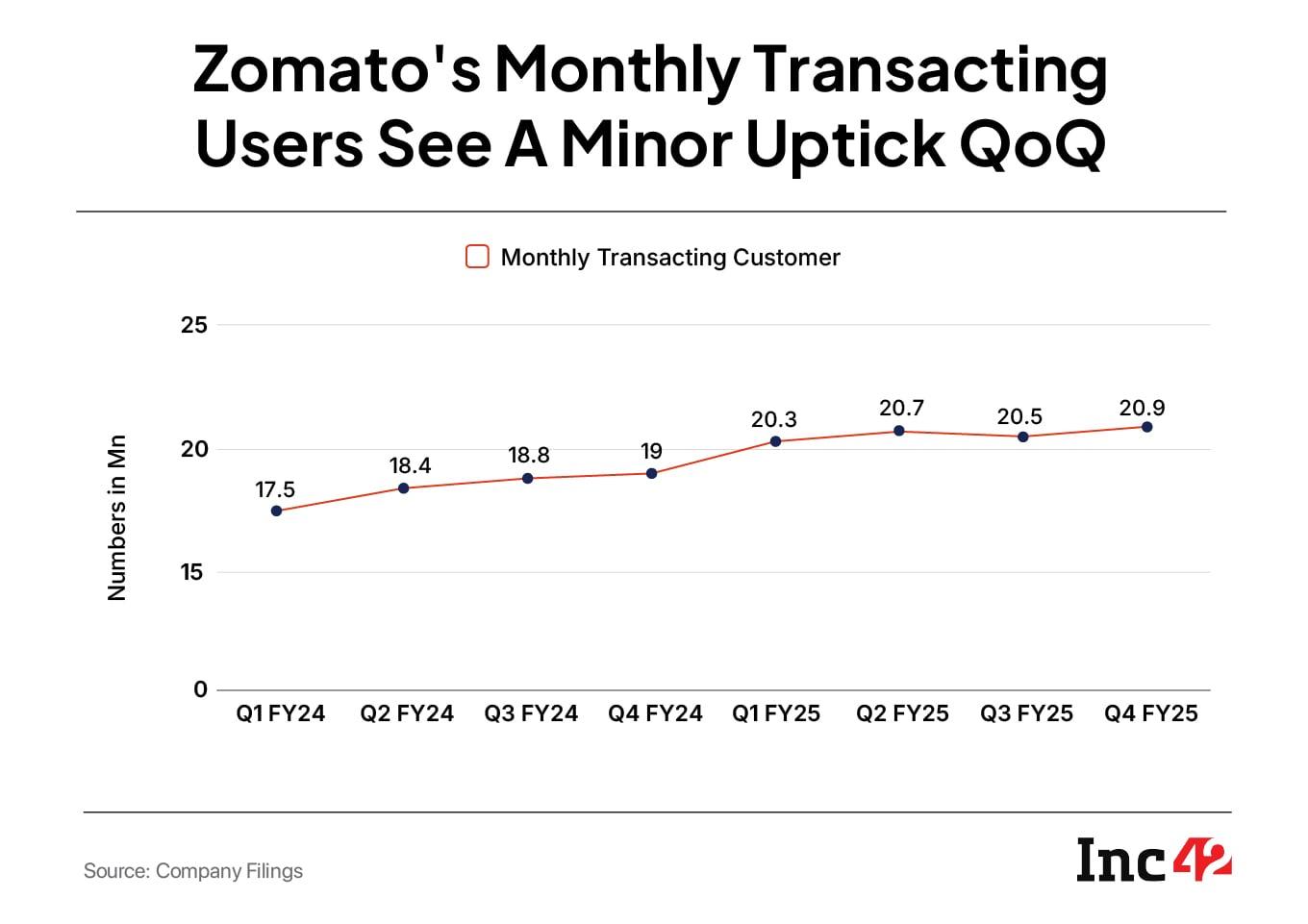

Also, a glance at the table below reveals how the company has seen a marginal QoQ increase in its monthly transacting users.

In terms of monthly transacting customers, Zomato’s food delivery growth began strong with a 6.84% QoQ jump in Q1, but momentum quickly slowed, and Q2 saw only a 1.97% sequential rise, followed by a slight decline of 0.97% in Q3. This dip signalled stagnation, and although Q4 showed a mild recovery (1.95%), overall FY25 growth of the company’s monthly transacting users (food delivery) was modest at just 2.96%

Interestingly, Eternal founder and CEO Deepinder Goyal, too, acknowledged a slowdown in the company’s food delivery business while announcing the company’s Q4 FY25 results. He said the slowdown was due to rising competition from quick commerce platforms and weak discretionary spending. Goyal added that services like Zepto Cafe, Swiggy Snacc, and Blinkit Bistro, too, were eating into demand for restaurant deliveries.

In terms of Zomato’s food delivery numbers, average monthly transacting numbers grew to 20.9 Mn in Q4 FY25 from 20.5 Mn in Q4 FY24. Net order value (NOV) growth also remained subdued at 14% YoY versus the 20% YoY growth guidance.

Hence, the company was under pressure to unlock new revenue streams. Blinkit’s success became the reference point, and the company started envisioning similar success stories with other verticals too, a former Zomato employee said.

This was when the company got engulfed in the wave of diversification, paving the path for Zomato’s yet another bold move (besides Blinkit) — the INR 2,078 Cr acquisition of Paytm’s movies and events ticketing business, Insider, in August last year.

The acquisition that was planned with the launch of the ‘District’ app meant but one thing — declaration of war against BookMyShow, the lone behemoth in the realm of the entertainment ticketing segment. Even the company knew the path wouldn’t be all rainbows and sunshine.

In its Q4 FY24 earnings call, the management acknowledged that while the gross order value (GOV) of the going-out vertical continues to grow at over 100% YoY, the business still operates at an adjusted EBITDA loss of -2 to -2.5% of net order value (NOV).

Besides, given that the transition of users from Paytm’s ticketing business and Zomato’s dining out platform to the District app requires sustained investment, the company doesn’t expect the business to turn profitable in the near term.

But Zomato expects losses to eventually see stability at current levels.

“However, even with plateauing losses, the company will have to keep spending on creating supply. This means: curating new event experiences, forging partnerships and acquiring new users for the District app… and all of this translates into one thing — prolonged burn,” the market analyst added.

Moving on, Zomato’s ambition to become a lifestyle super app didn’t just manifest into flashy verticals like events, entertainment, and ticketing — it also showed up in its renewed aggression in food delivery, the very space where it first made its name.

Therefore, Zomato began piloting a 15-minute food delivery service in select parts of Mumbai and Bengaluru early this year.

But the company now finds the initiative extremely difficult to operationalise as it has failed to generate incremental demand.

“Customers do not necessarily want food fast, they just want it reliably. A 10-minute turnaround without full control over the supply chain leads to poor customer experiences, operational stress, and negligible upside. Instead of delighting users, it makes the company vulnerable to inconsistent quality and frequent delays,” a Zomato insider added.

Satish Meena, the founder of Datum Intelligence, opined that without controlling the entire supply chain, delivering food items within 10 to 15 minutes cannot be a profitable proposition.

Swiggy’s U-TurnsIn 2024, also the year of its public listing, Swiggy aggressively expanded its service offerings, launching several new verticals to diversify beyond its core food delivery business.

Among the most prominent launches was Bolt, a 10-minute food delivery platform. Initially launched in Bengaluru, Chennai and Mumbai, Bolt quickly expanded to over 400 cities, with over 40,000 restaurants, including KFC, McDonald’s and Starbucks.

To complement Bolt, Swiggy introduced Snacc, a separate app for instant delivery of snacks, beverages, and small meals within 15 minutes.

Continuing to diversify its portfolio, Swiggy launched Pyng, an AI-powered platform that bridges users with verified experts like yoga teachers or chartered accountants.

With this, Swiggy marked its entry into the on-demand services marketplace, making professional services easier to access.

Apart from these customer-facing services, Swiggy also entered events via Scenes and the B2B space with Assure, to keep pace with Zomato.

Interestingly, Swiggy, too, has begun consolidating its operations. The company has shut down Genie, its hyperlocal courier business, which competed with Porter, Borzo and Uber.

According to a competitor, sourcing delivery riders specifically for packages is a challenge, particularly in cities like Bengaluru. For Swiggy, which was already managing fleets for food delivery and quick commerce through Instamart, sustaining a separate rider network for Genie only added to the complexity.

In another such move, Swiggy exited its private label food business by transferring exclusive rights for its digital-first brands, including The Bowl Company and Homely, to cloud kitchen operator Kouzina.

Balance Sheet BluesImperative to highlight that the rollbacks by Zomato and Swiggy are rooted in the growing pressures on their respective balance sheets.

After diversifying at a breakneck speed, they are now faced with the hard realities of cost structures that don’t always align with revenue potential.

In Q4 FY25, Zomato and Swiggy both reported robust top-line growth. Zomato’s revenue surged to INR 5,833 Cr, largely buoyed by its three core pillars — the food delivery business (INR 1,739 crore), Blinkit’s quick commerce arm (INR 769 Cr), and Hyperpure, its B2B supply chain vertical, which posted a 99% YoY growth in revenue to INR 1,840 Cr.

However, despite the momentum, the company’s in the quarter, largely thanks to ongoing investments in Blinkit and newer bets like the ‘District’ lifestyle app.

Meanwhile, , up 45% YoY, but saw its net loss nearly double to INR 1,081 Cr. The widening losses were fuelled by surging operational expenses.

Platform Fee To The Rescue… But For How Long?“All of this explains the strategic pullbacks witnessed lately, Swiggy exiting Genie and private labels, Zomato pulling the plug on services like Quick and Legends. The rationalisation marks a reset, indicating that while growth via diversification was necessary, financial discipline and profitability are in the spotlight,” the market analyst said.

While it won’t be easy for Zomato and Swiggy to suddenly change course, the future of these two foodtech giants is all about heading towards a more focussed set of revenue streams driven by value rather than FOMO.

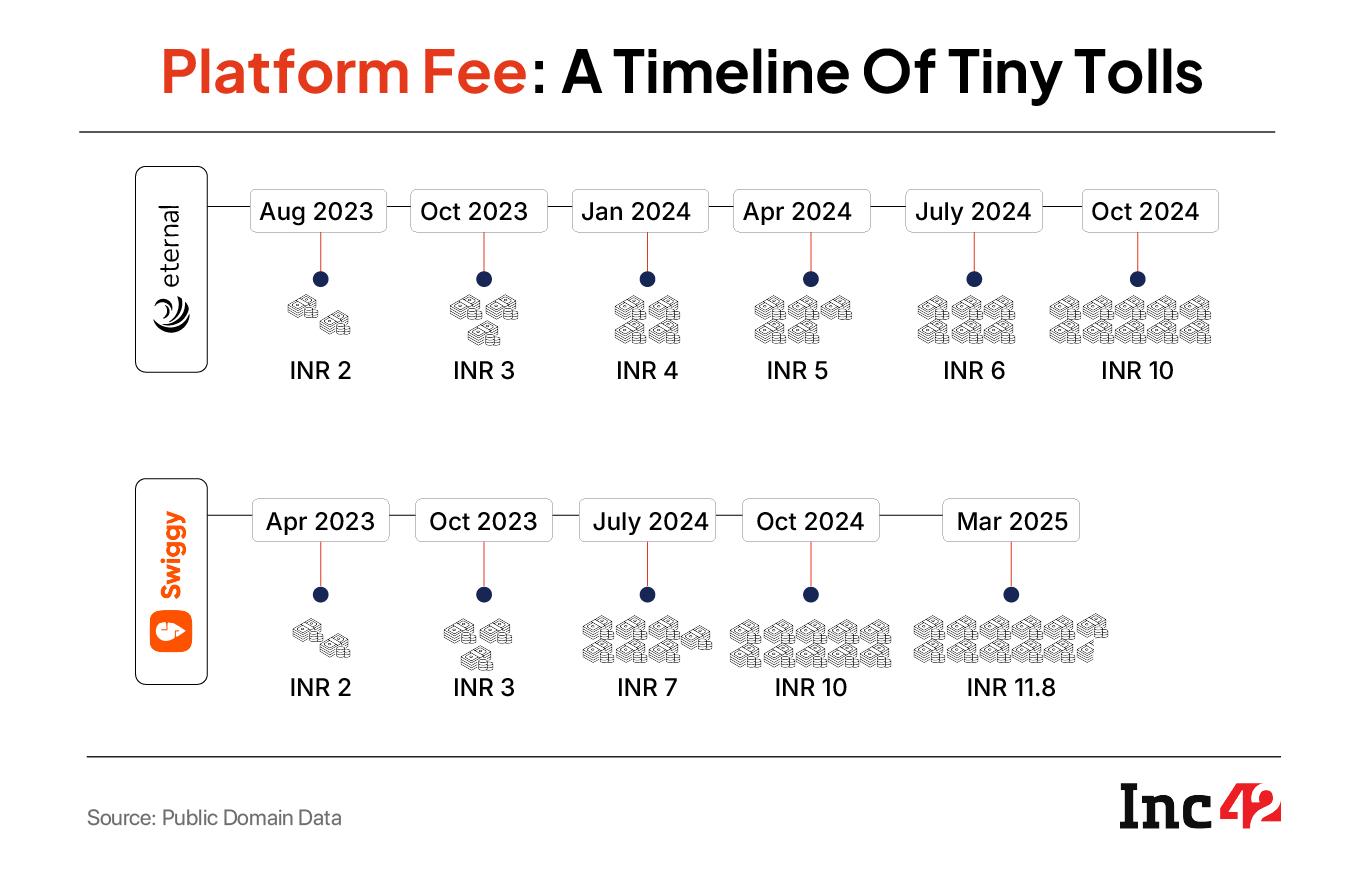

In the process, both foodtech giants appear to have struck gold with the platform fee, which has grown from just INR 2 in 2023 to INR 10 today.

But the real question is: Can rising platform fee help the duo neutralise the impact of aggressive expansion? Or is rationalisation the only way forward?

Devangshu Dutta, the founder of Third Eyesight, thinks otherwise. He believes that the companies will not stop looking for new revenue streams, even as they will continue to amputate the ones that offer little value.

“All of these companies have to look for growth, which is a given. If their existing businesses are not delivering the kind of growth they need to justify their stock price or valuation, then they have to look at new avenues.”

According to him, we are bound to see a flurry of experiments, trials of different services and new verticals as these companies attempt to expand their addressable markets.

At the end of the day, the foodtech duo is stuck in a balancing act of rationalising what works and doesn’t. However, going ahead, this rationalisation game is only going to get more pronounced as they will strive to shield their core bread and butter businesses.

[Edited by Shishir Parasher]

The post appeared first on .

You may also like

Actress who worked with Rekha claims diva was 'jealous' of her: 'She made faces at me'

"Burden has been lifted from earth": Jharkhand DGP Anurag Gupta after two Naxalites killed in encounter

Dermatologist says she's not needed to 'redo Botox' as soon by using skincare that's £1.50 in deal

5 Essential Vitamins for Hair Growth

How Swiggy & Zomato Are Hitting The Brakes In The Race To Be Everything Everywhere All At Once