Mr. Bandopadhaya (name withheld) had the worst day ever when the income tax department sent him a draft assessment order that added Rs 2.28 crore (2,28,14,293) to his account. Bandopadhaya is a non-resident Indian citizen who hadn’t filed any income tax return (ITR) for the year in question.

After gathering information and details, the tax officer noticed that the assessee (Bandopadhaya) had made numerous financial transactions. Consequently, a tax notice under Section 148 of was issued, and in response, Bandopadhaya, filed his ITR on June 1, 2022, reporting a total income at Rs 3.83 lakh (3,86,620).

On March 17, 2023, the tax officer issued a draft assessment order under Section 144C of the Income Tax Act, 1961, adding Rs 2.28 crore (2,28,14,293) as unexplained money under Section 69A read with Section 115BBE and proposed a total income assessment of Rs 2.32 crore (2,32,00,913).

Feeling aggrieved with this draft assessment, Bandopadhaya filed his objections the Dispute Resolution Panel (DRP) on April 13, 2023. The DRP called for a remand report which was placed on record by the ITO/Assessing Officer on November 30, 2023, followed by a second remand report on December 21, 2023.

The DRP after taking reviewing the remand reports, concluded that the nature and source of money in the bank deposits made by the assessee (Bandopadhaya) were not satisfactorily explained. As a resuly, they dismissed the application of the assessee (Bandopadhaya) with a directive dated December 29, 2023. Following this, the Assessing Officer issued an assessment order on January 19, 2024, whicj included an addition of Rs 2.28 crore (2,28,14,293) as unexplained money under Section 69A in conjunction with Section 115BBE.

Unhappy with the DRP order, of DRP, Bandopadhaya appealed to the Income Tax Appellate Tribunal (ITAT) Ahmedabad. The ITAT Ahmedabad partially allowed his appeal and deleted all but Rs 63,133 of the income classified as unexplained money.

Also read: Govt deducted Rs 9.23 lakh from pension of late employee; employees' legal heirs fight back, win the case in Chhattisgarh High Court

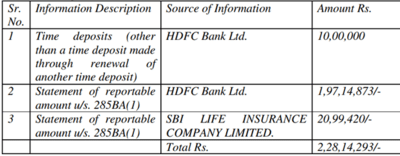

Here’s a table showing the nature and source of income which is the reason why Bandhopadhaya got the tax notice:

Source: ITAT Ahmedabad judgement

Also read: Taxpayer deposits Rs 20 lakh in NRE bank account, skips ITR; income tax dept issues notice but he wins in Gujarat High Court for this reason

ITAT Ahmedabad says this

ITAT Ahmedabad in its judgement (ITA No. 458/Ahd/2024) said that they have heard both the parties and perused all the relevant materials available on record.

ITAT Ahmedabad said that it is pertinent to note that on page 13 to 23 of the directions dated December 29, 2023 passed by the DRP, the Assessing Officer himself has categorically mentioned that the assessee (Bandopadhaya) has filed copy of fixed deposit summary, copy of bank accounts statements with the HDFC and SBI, copy of investment in time deposit HDFC and copy of SBI life Insurance company and in fact the first remand report has also been reproduced and in the remark column related to the transactions where the assessee has explained the source of the funds.

Also read: Son applies for late father’s bank job on compassionate grounds, gets no response for years, files case, wins Rs 1 lakh, Allahabad High Court order

The sources which have not been explained have been explained by the assessee (Bandopadhaya) which is reflected in the second remand report dated December 21, 2023 which is reproduced at page 35 to 40 of the DRP’s directions.

The assessee (Bandopadhaya) at that juncture has filed bank statements of various accounts and has also given the details of fixed deposits held by SBI and summarized explanation of credit and debit entries in his NRE/NRI held by SBI and HDFC bank.

Also read: Homebuyer was denied Rs 10 lakh capital gain tax exemption by Income Tax dept for not depositing unutilised land sale gains in CGAS on time, he wins case in ITAT Chennai

ITAT Ahmedabad said: “From the remark column thereon it can be seen that only one entry of 63,133/- was not explained but the rest of the entries and the transactions were totally explained and verified by the Assessing Officer. It can be seen in para 4 of the said remand report at page 39 of the DRP’s direction.”

Judgement: “Once, the assessee (Bandopadhaya) has submitted all the credit entries along with debit entries and also that of the submission of employment verification letter, doubting the genuinely of the said documents without any basis is not justifiable on the part of the Assessing Officer as well as by the DRP. Thus, the Assessing Officer as well as CIT(A) except the entry of 63,133 should not have made addition u/s. 69A as unexplained money because the assessee (Bandopadhaya) has explained all the details of the rest of the entries. Thus, the appeal of the assessee is partly allowed except the component of Rs 63,133. In the result, the appeal of the assessee is partly allowed.”

After gathering information and details, the tax officer noticed that the assessee (Bandopadhaya) had made numerous financial transactions. Consequently, a tax notice under Section 148 of was issued, and in response, Bandopadhaya, filed his ITR on June 1, 2022, reporting a total income at Rs 3.83 lakh (3,86,620).

On March 17, 2023, the tax officer issued a draft assessment order under Section 144C of the Income Tax Act, 1961, adding Rs 2.28 crore (2,28,14,293) as unexplained money under Section 69A read with Section 115BBE and proposed a total income assessment of Rs 2.32 crore (2,32,00,913).

Feeling aggrieved with this draft assessment, Bandopadhaya filed his objections the Dispute Resolution Panel (DRP) on April 13, 2023. The DRP called for a remand report which was placed on record by the ITO/Assessing Officer on November 30, 2023, followed by a second remand report on December 21, 2023.

The DRP after taking reviewing the remand reports, concluded that the nature and source of money in the bank deposits made by the assessee (Bandopadhaya) were not satisfactorily explained. As a resuly, they dismissed the application of the assessee (Bandopadhaya) with a directive dated December 29, 2023. Following this, the Assessing Officer issued an assessment order on January 19, 2024, whicj included an addition of Rs 2.28 crore (2,28,14,293) as unexplained money under Section 69A in conjunction with Section 115BBE.

Unhappy with the DRP order, of DRP, Bandopadhaya appealed to the Income Tax Appellate Tribunal (ITAT) Ahmedabad. The ITAT Ahmedabad partially allowed his appeal and deleted all but Rs 63,133 of the income classified as unexplained money.

Also read: Govt deducted Rs 9.23 lakh from pension of late employee; employees' legal heirs fight back, win the case in Chhattisgarh High Court

Here’s a table showing the nature and source of income which is the reason why Bandhopadhaya got the tax notice:

Source: ITAT Ahmedabad judgement

Also read: Taxpayer deposits Rs 20 lakh in NRE bank account, skips ITR; income tax dept issues notice but he wins in Gujarat High Court for this reason

ITAT Ahmedabad says this

ITAT Ahmedabad in its judgement (ITA No. 458/Ahd/2024) said that they have heard both the parties and perused all the relevant materials available on record.

ITAT Ahmedabad said that it is pertinent to note that on page 13 to 23 of the directions dated December 29, 2023 passed by the DRP, the Assessing Officer himself has categorically mentioned that the assessee (Bandopadhaya) has filed copy of fixed deposit summary, copy of bank accounts statements with the HDFC and SBI, copy of investment in time deposit HDFC and copy of SBI life Insurance company and in fact the first remand report has also been reproduced and in the remark column related to the transactions where the assessee has explained the source of the funds.

Also read: Son applies for late father’s bank job on compassionate grounds, gets no response for years, files case, wins Rs 1 lakh, Allahabad High Court order

The sources which have not been explained have been explained by the assessee (Bandopadhaya) which is reflected in the second remand report dated December 21, 2023 which is reproduced at page 35 to 40 of the DRP’s directions.

The assessee (Bandopadhaya) at that juncture has filed bank statements of various accounts and has also given the details of fixed deposits held by SBI and summarized explanation of credit and debit entries in his NRE/NRI held by SBI and HDFC bank.

Also read: Homebuyer was denied Rs 10 lakh capital gain tax exemption by Income Tax dept for not depositing unutilised land sale gains in CGAS on time, he wins case in ITAT Chennai

ITAT Ahmedabad said: “From the remark column thereon it can be seen that only one entry of 63,133/- was not explained but the rest of the entries and the transactions were totally explained and verified by the Assessing Officer. It can be seen in para 4 of the said remand report at page 39 of the DRP’s direction.”

Judgement: “Once, the assessee (Bandopadhaya) has submitted all the credit entries along with debit entries and also that of the submission of employment verification letter, doubting the genuinely of the said documents without any basis is not justifiable on the part of the Assessing Officer as well as by the DRP. Thus, the Assessing Officer as well as CIT(A) except the entry of 63,133 should not have made addition u/s. 69A as unexplained money because the assessee (Bandopadhaya) has explained all the details of the rest of the entries. Thus, the appeal of the assessee is partly allowed except the component of Rs 63,133. In the result, the appeal of the assessee is partly allowed.”

You may also like

Heavy rain likely in Kerala, IMD issues yellow alert in five districts

'I ditched expensive calendars for Sephora's £90 beauty equivalent of a Quality Street tin'

Three Arrested For Gangrape Of Odisha Medical Student In Bengal; Hunt On For Two Others

Silver Scales New Peak At ₹1.64 Lakh, Gold Glitters With ₹2,000 Surge — What's Driving The Precious Metal Rally?

Match Preview: India Faces Australia in ICC Women's World Cup 2025 Showdown